William Pitt – Julia B. Fee Sotheby’s International Realty reported today that ongoing limited inventory continued to affect New York suburban residential real estate markets in May, leading to declining sales compared to May 2021. Buyer demand was still elevated as New York City residents continue to seek suburban housing at historically high levels. The company also noted that the timeframe of comparison, May 2021, was one of record sales, climbing well ahead of a month in 2020 when real estate activity was only starting to come back amidst pandemic shutdowns.

Both new listings taken and overall inventory declined by significant percentages versus May 2021 in most markets.

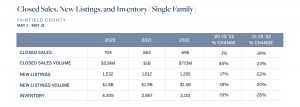

In Fairfield County, Conn., unit sales and closed dollar volume declined in May versus the same month last year by 19% and 23%, respectively, continuing the trend that began in June 2021 when sales started competing with a period of unprecedented growth the prior year. Overall inventory was down 26% compared to May last year while new listings for the month decreased by 22%.

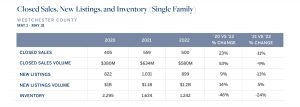

In Westchester County, N.Y., unit sales and closed volume decreased by 11% and 9%, respectively, from May last year. As in Fairfield County, limited inventory greatly impacted the market, with overall inventory down by 24% compared to May 2021 and new listings down by 13%.

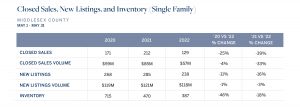

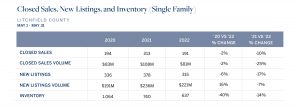

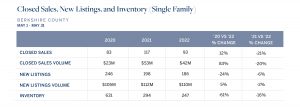

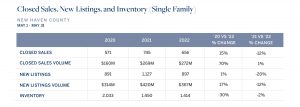

Other markets served by the company witnessed similar trends. Middlesex, New London, Litchfield and Hartford Counties in Connecticut and the Berkshires in Massachusetts all experienced significant decreases in unit sales and dollar volume versus last April’s record month. New Haven County alone saw a mild uptick in closed volume while unit sales stayed down, an indication of more higher priced properties transacting. All markets were also challenged by low inventory.

Please see the accompany charts for a full review of the data for all market areas, comparing May 2022 to both May 2021 and May 2020, sourced from various MLSs.

“We will continue to monitor key economic indicators including consumer confidence, but for now the market trends we are witnessing—a decrease in sales, a shortage of inventory and rising prices—suggest market activity will remain busy throughout the year,” said Paul Breunich, Chairman and Chief Executive Officer of William Pitt – Julia B. Fee Sotheby’s International Realty. “Buyer demand in our markets, largely emanating from New York City, shows no sign of abating.”